According to the Upply database, the prices of road freight transport in France were on the rise in August 2019 by 0.6% compared to July. However, the evolution remains negative (-0.9%) compared to August 2018.

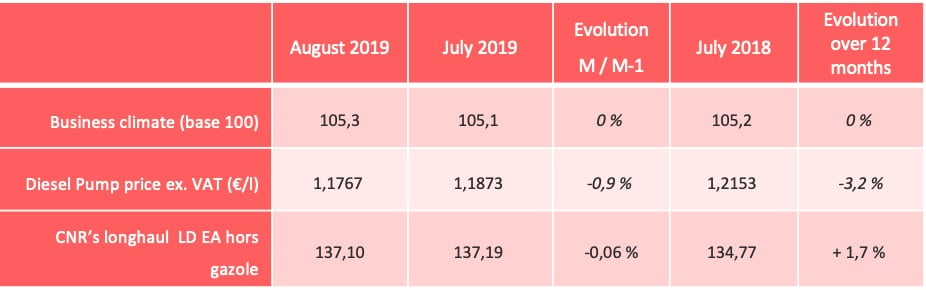

The price of road transport has been continually rising over the month of August which compensates for the fall that was observed in July. The market does not seem to be adversely affected by the international tensions. The general business climate remains stable (see our table of the principal market indicators at the end of this article).

The transport market on a national level

August has shown itself to be in line with what has been observed since the beginning of the year.

The comparison between 2018 and 2019 has shown a linear tendency of an increase in price for road transport in France. This price recovery in August should be viewed with caution as should the annual global tendency. The small volume of business over the month of August has led to a distorted vision of the reality.

Several reasons may explain this rise in prices observed over the month of August which is contrary to what would normally be expected during this period:

• The rise in diesel prices of 4% observed in July was passed on with a certain delay that equated to around a month. If we continue to follow this assumption, then the fall in diesel prices of 1% during August will mean that transport prices will then also fall slightly during the month of September

• The fighting spirit of French carriers has been greatly strengthened by the government’s projects to add surtaxes on transport (reduction of the partial tax rebate on diesel, the gradual phasing out of the tax break on “offroad” diesel, suppression of the reductions in social security contributions, rise in taxes on short-term employment contracts, re-evaluation of warehouse taxation). In an interview broadcast on the news channel LCI (in French), Élisabeth Charrier, regional delegate and general secretary of the FNTR, Ile-de-France and Centre (National Federation of French Carriers, Greater Paris and Centre regions) reminded us that this series of measures represents €1bn of additional taxation. The news channel also gave the opportunity for the president of the OTRE to express herself during a debate with political representatives (from the 39th minute onward, in French). “We do not aim to remain in the vacuum that is France”, she insisted.

Focus on the Hauts-de-France region

With the Braderie of Lille having just come to an end let us have a look at import and export road transport in the Hauts-de-France region.

The region benefits from a geostrategic position that is right in the centre of Western Europe: it is situated on the very famous Blue Banana, which means that its transport prices react to specific characteristics.

- The region is awash with fleets from foreign transport companies (Belgian, Dutch, German and Polish) which puts transport prices under pressure. The median price observed in the Hauts-de-France region is lower than the national median.

- There is a substantial imbalance between the import and export prices; as such on the 27th of August the price of transport leaving Lille for the rest of France was €1.47/km compared to €1.19/km for transport in the other direction, a difference of almost 30 centimes. The region is a high net exporter.

- The volatility of transport prices is less significant than elsewhere in France; this is due to the disparity between import and export prices that compensates the differences in prices as is shown in the graph below.

One final point to be taken into consideration is that the Hauts-de-France region will be potentially greatly affected by Brexit over the next few weeks. The ports of Calais and Dunkirk are the natural points of access to the UK from continental Europe. There are many “Cassandras” who prophesize a chaotic situation for cross-border exchanges due to horrendous queues.

A few discordant voices have been heard, such as that of France Beury, delegate for European & International Affairs at TLF Overseas, that have pointed out that a great deal of work has already been carried out by the Customs Services, the ports and the Registered Customs Representatives (RDE in French). According to Madame Beury, the implementation of a Smart Border will be difficult but should take no more than 3 months to set up.

THE PRINCIPAL MARKET INDICATORS