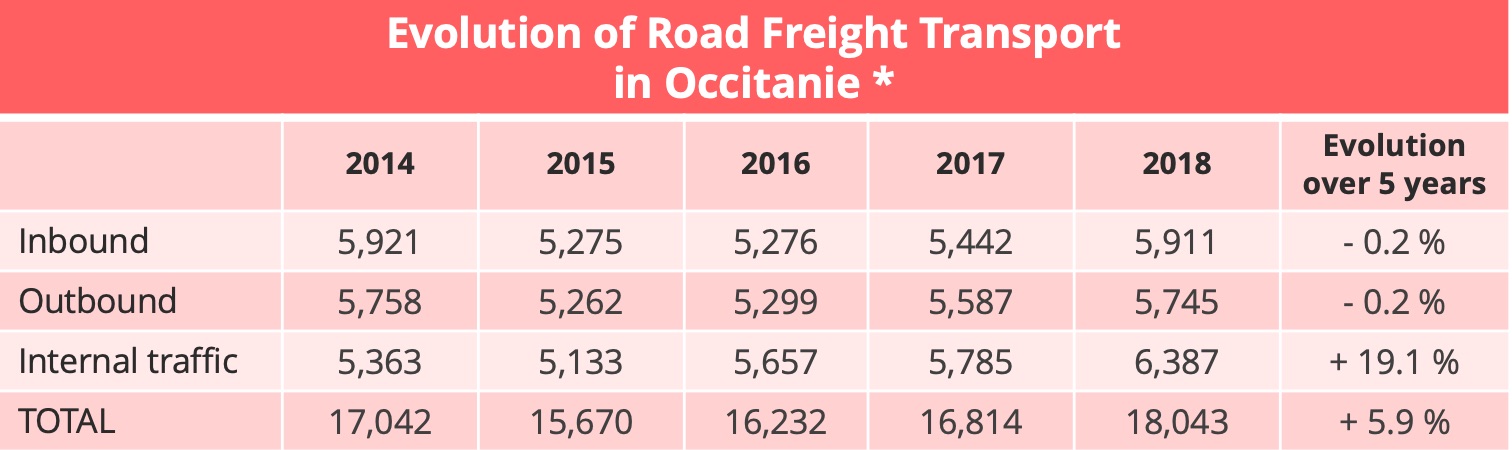

DOSSIER. Road freight transport in the Occitanie region has increased by 5.9% in 5 years, driven by internal flows. The sector benefits also from the stability of inflows and outflows.

Road freight transport (RFT) in Occitanie is in quite good shape. "In 2018, it increased more dynamically than in metropolitan France in general" reaching 2014’s levels of trade and even exceeding them with regard to the traffic flows carried out within the territory, underlines the Insee in its regional economic report. French flagged companies generated a total traffic of 18 billion tonne-kilometers in the Occitanie region, an increase of 7.3% compared to the previous year, according to figures from the Ministry of Transport.

Internal traffic predominant in the last three years

As in the rest of France, RFT began its recovery as of 2016, and has shown over 5 years a virtual stability of incoming and outgoing traffic flows and a clear increase in internal flows, measured in tonne-kilometers transported. With a new double-digit growth between 2017 and 2018, internal flows are undoubtedly spearheading the sector. They represented 35.4% of total traffic in 2018 and are up by 10.4% compared to the previous year. Inflows also performed well, with a growth of 8.6% compared to 2017, while outflows grew by 2.8%.

* in millions of tonne-kilometers transported - Source : SDES, Road Freight Transport Survey

The characteristics of the region's economy partly explain why internal flows have increasing importance. Apart from the very specific aeronautical activity, for which the traffic generated is largely by air, Occitanie does not possess an extensive industrial network. Road freight transport is mainly fueled by consumers on the one hand, which is itself driven by the region's demographic dynamism and by tourism, and on the other hand by the importance of the agricultural activities, including viticulture.

3,600 road freight transport establishments

According to the 2018 regional report of the OPTL (Prospective Observatory of professions and qualifications in Transport and Logistics), the road freight transport sector as of December 31st, 2017 had around 3,600 establishments in Occitanie, of which 1,850 employed staff. Of these, 65% had between 1 and 9 employees, 30% between 10 and 49 employees and 5% more than 50 employees. In addition to the large national groups established locally, Occitanie is home to some first-rate regional SMEs such as Jardel, Denjean Transports, The Jimenez group or the combined transport specialist TAB Transports.

"The volumes transported are mainly related to mass retail distribution, around major roads such as the Mediterranean arc, which is fairly dense in population, and to a lesser extent along the A75, towards the Massif Central and the Center", indicates Françoise Gleize, Occitanie Méditerranée regional delegate of the FNTR . The presence of the Saint-Charles market, the leading European platform for fruit and vegetables, also attracts significant traffic of fresh produce from local producers but also from southern Europe and North Africa. Finally, the activity of road hauliers is fueled by the construction industry, a sector that benefits from the region's increasing population.

In general, the activity of French road carriers in the region relies heavily on short hauls. With regard to inflows and outflows, Occitanie also trades primarily with neighboring regions, as indicated in a note from the Regional Transport Observatory (ORT) published in November 2019, based on tonnages transported in 2018. The Occitanie region accounted for 8.88% of the overall flow of goods transported in France, with a total of 155 Mt, including 112.4 MT of internal traffic, 21.7 Mt of outflows and 22.4 Mt of inflows. “The total flow of goods loaded in the Occitanie region and delivered outside Occitanie is mainly destined for three regions: Provence-Alpes-Côte d’Azur : 7.2 Mt (33.2 %) ; Nouvelle Aquitaine : 6.7 Mt (30.7 %) ; Auvergne-Rhône-Alpes : 4 Mt (18.4 %). These three regions alone represent 82% of the flow of goods loaded in Occitanie, ” indicates the ORT. We also find these three regions for the inflows though in a different order: Nouvelle Aquitaine : 7.8 Mt (34.6 %) ; Provence-Alpes-Côte d’Azur : 6.5 Mt (29.2 %) ; Auvergne-Rhône-Alpes : 3.9 Mt (17.3 %). They account for 81% of the flow of goods delivered to Occitanie.

Strong competition from foreign heavyweights

Obviously, given its geographical position, local carriers face stiff competition from Spain. “Even if the disparity has been reduced, costs remain lower. And on top of this we must include the other foreign heavyweights, from Eastern countries or Turkey, for example,” points out Jérôme Bessière. “Our French companies have no other choice than to focus on quality, both in terms of quality of life at work in the face of recruitment difficulties and in terms of customer service quality. This is a real issue that many have already addressed. Moreover, since 2013, the sector has been rallying and we have achieved a fairly good balance between supply and demand. Unfortunately, the Covid-19 epidemic has stopped us in our tracks,” notes Françoise Gleize.

“There had been a certain stability since 2019, before the collapse observed in the spring”, confirms Jérôme Bessière, Occitanie Pyrénées regional delegate of the FNTR. “The shock was perhaps a little less violent in Occitanie than elsewhere, due to the scarcity of industry and the weight of the agricultural and agro-food sector which continued to function. Another positive sign: the recovery is a little less sluggish than first feared. However, we must still exercise caution. Firstly, because the recovery is partly the result of the effect of companies taking up the slack, for example in the construction industry. Secondly because the feedback from the field is starting to show an increased presence of low-cost foreign-flagged companies. "Due to the lack of the same financial support in their countries that we received during the Covid-19 crisis, they are ready to offer particularly low prices", regrets Françoise Gleize.

The Occitanie Logistics Cluster, founded in 2019, also makes the subject of competitiveness a major focus of its action. “We must help small local carriers to identify the markets in which they can make an offer that sets them apart, for example where in-depth knowledge of the local fabric is an asset. In certain sectors, such as agriculture and agro-food, we are also working on solutions that allow for logistics optimization, for they are costly in the remoter areas of Occitanie”, explains Isabelle Bardin, director of We4log, the Logistics Cluster from Occitanie.

Building on the acceptability of the sector

The cluster's mission is also to develop multimodality. It has already carried out work to map out services of this type, as part of the European TRAILS project (Transnational Intermodal Links Towards Sustainability). The carriers seem quite favorable to this move, but there is still a very long way to go yet, given the constraints linked to rail transport. The example of the Perpignan-Luxembourg rail highway (AFPL) is enlightening. “Overall, the traffic on the AFPL still only represents a modest contribution in terms of modal shift : the 40,000 semi-trailers that are transported annually on this line should be compared to the number of trucks passing by road on the same route, estimated at 630,000 units per year. AFPL traffic therefore represents only 6% of all heavy goods vehicle traffic on this route,” pointed out the Court of Auditors in its 2017 annual report.

In the meantime, the traffic continues to increase. “In 2019, heavy goods vehicle traffic increased on all of the region's freeways under concession. The heaviest traffic for trucks (greater than 10,000 per day and per kilometer) is concentrated on the A9 freeway with increases of 3.5% east of Montpellier, and 4.7% on the Montpellier-Narbonne section and 4.6% between Narbonne and the Spanish border. The A54 freeway, between Nîmes and Arles, recorded a growth of 5.4% with 7,240 heavy goods vehicles per day and per kilometer,” explains INSEE. Finally, on the outskirts of the Toulouse metropolitan area, heavy goods vehicle traffic showed strong growth in 2019 after a decline in 2018”, adds the institute.

In the longer term, the Logistics Cluster sees the Hydrogen plan supported by the Occitanie Region as another promising area. This plan is not solely dedicated to the road freight transport sector, but it can be "an incentive for innovation in the sector", believes Isabelle Bardin.