The ancient silk road used to connect China and Central Asia by using camels, and now China aims to connect the Eurasian continent via the iron belt, its new railway initiative.

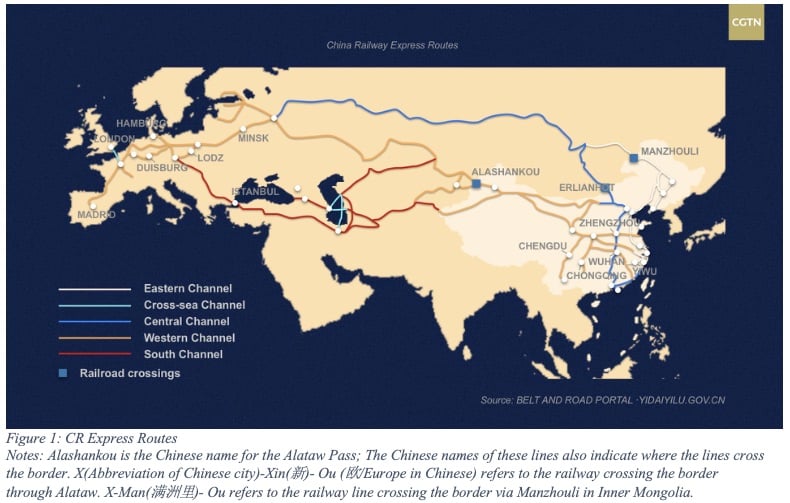

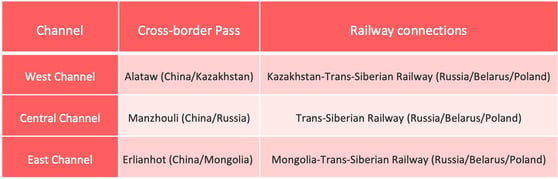

The 2016-2020 China Railway Express plan issued by the Chinese National Development and Reform Council (NDRC) in 2016 outlined a concrete plan: building 43 railway lines connecting European and Chinese cities via three railway channels. The three channels feed into the trans-Siberia Railway system via different cross-border passes: Alataw, Manzhouli, and Erlianhot.

Currently, Alataw and Manzhouli are the most used passes in the CR Express. As for the European destinations of the CR Express, most of them are in Germany (mainly Duisburg) and Poland. The former is the largest innerport in the world and the latter is the first EU country to welcome the CR Express. From there, containers can be transferred to other destinations in Europe.

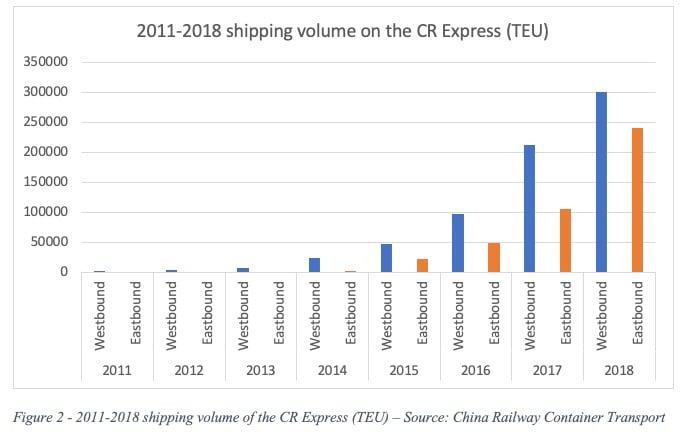

The CR Express is mainly used to ship IT products, machinery, and transport components. It first started operating in 2011, when Hewlett Packard opened its manufacturing plant in Chongqing, an industrial city in Southwestern China. The demand for fast and cheap shipping for IT products led to the creation of the first CR Express line: Chongqing-Duisburg. While today many more types of goods are shipped through the CR Express, IT products continue to be one of the line’s main product type.

Railway transport has experienced a rapid increase since the plan was first issued in 2016. In 2018, there were 56 CR Express lines connecting Chinese cities to Europe (more than the 43 originally foreseen), with 6,363 shifts in total, surpassing the goal of 5,000 shifts per year set by NDRC two years before that. Today, Chinese imports transported via railway make up a third of all non-EU imports to the EU. Nevertheless, and despite the rapid development of railway shipping between China and Europe, the goods shipped via railway only represent about 3% of the total EU-China trade value.

A highly policy motivated initiative

As part of the Belt and Road Initiative, the China Railway Express is, by nature, a government supported initiative. This motivated local authorities to set up their own CR Express lines to contribute to their own political achievements. Apart for the Yiwu-Madrid line, all the railway operators are state-own enterprises or public-private joint corporations. In some cases, several state-owned companies can operate in one single province.

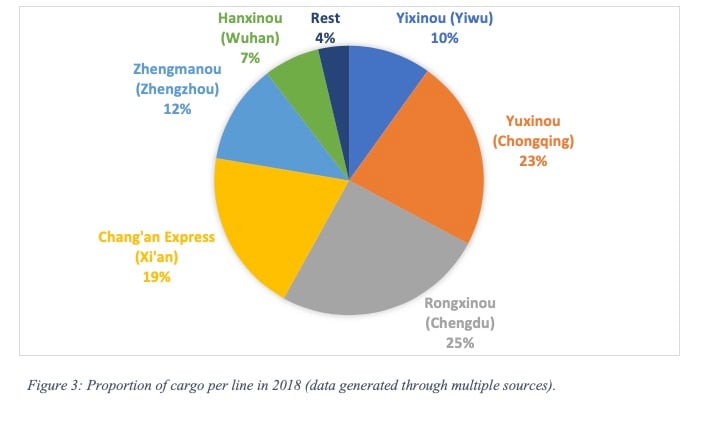

Nevertheless, the development of these lines is asymmetrical. Chongqing-Duisburg, Chengdu-Lodz, Xi'an-Hamburg, Zhengzhou-Hamburg, Wuhan-Hamburg, and Yiwu-Madrid account for over 90% of the total annual cargo travelling on the CR Express.These cities operate more than one line. The lines mentioned above are the main ones or the first one they started to operate. And container shipping on the Chongqing-Duisburg and Chengdu-Lodz routes make up a third of the total volume of containers shipped of the CR Express in 2018.

The asymmetrical development also affects the eastbound/ westbound balance. While in 2018 the overall eastbound volume represented about 70% of the westbound volume, most of the eastbound volume travels on the abovementioned lines. In other words, many CR Express lines still suffer from eastbound over-capacity. According to the data from Eurostat, eastbound transport accounts for 43% of the total value of railway trade, and represents 36% of the total volume.

To attract shippers, local governments subsidize their CR Express lines, thereby making railway freight rates competitive. Usually, subsidies are around 3,000 US dollar per container, and they tend to affect the shippers' choice of shipping route. For instance, according to one Chinese news report, the competitive prices of the Chang’an CR Express (Xi’an-EU) attracted customers from Eastern China where other CR lines are also available.

Attempts at liberalization

A crucial question is whether the CR Express can still be attractive to shippers without the subsidies. It has been reported recently that the Chinese government is going to limit local government subsidies to the CR Express, in an attempt to make it more market oriented. In recent years, the CR Express system started digitalizing the customer clearance process to facilitate trade, and offered exclusive cargo opportunities for logistics companies or manufacturers, to make the system more competitive.

The CR Express cooperates with private logistics companies by providing cargo shifts dedicated to the company’s goods. For instance, in January 2018, SF express, a major player in the Chinese logistics industry, in cooperation with the Government of Jiangxi, operated one shift between Gangzhou (Jiangxi province) and Finland for wood. Similarly, Cainiao, Alibaba's logistics subsidiary, in collaboration with Zhengzhou, ran the "Cainiao" cross-border e-commerce cargo shift in March 2019. And Xi'an also cooperates with foreign logistics company, like the Japanese player Nippon Express.

Some of the lines also sought to directly cooperate with manufacturers to provide a dedicated cargo service for these companies. Therefore, there are cargos exclusively dedicated to one company, which is the case for Volvo, Porsche, Decathlon, and Foxconn, which all ship from China to Europe.

The CR Express as part of China’s global shipping network

On August 15, the Chinese government issued a plan to develop the land-water connection between China and South(east) Asia from now until 2025. In this plan, Chongqing will serve as the focal point, connecting three major multi-modal shipping channels: the CR Express, the New land-sea Channel and the Railway channel along the Yangzi River (with a connection to Shanghai).